On April 7, 2023, Vietnam Report Joint Stock Company (Vietnam Report) officially published the list of Top 10 Real Estate Enterprises in 2023

This is the result of an independent research by Vietnam Report, based on scientific and objective principles to recognize and award the backbone companies in the real estate industry, which have made great efforts to accomplish outstanding results in business, branding, growth and stable financial capacity, good resilience in a volatile global market.

These enterprises, selected from Vietnam Report’s previous ranking researches in the real estate industry with financial data updated to December 31, 2022, were evaluated using Media Coding method (encoding press data in the media) and surveying, to produce the most objective and thorough assessment.

List #1: Top 10 Real Estate Investors in 2023

List #2: Top 10 Industrial Real Estate Enterprises in 2023

List #2: Top 10 Industrial Real Estate Enterprises in 2023

Source: Vietnam Report, Top 10 Real Estate Enterprises in 2023, April 2023.

Overview of Real Estate market in 2022:

Post COVID-19, the real estate market had many opportunities to recover and develop in 2022. In the first quarter, many investors planned to open sales for real estate projects, making real estate number 2 in attracting foreign direct investment (approx. USD 600 million), obtaining the highest M&A value in 5 years (approx USD 1 billion)…

The excitement did not only come from the supply side, demand increased in almost every segment, especially for land. However from April, the market gradually subsided with a decline in purchases, firstly of rural land, followed by the mid to high-end apartments in large townships. Sales of serviced apartments, offices for rent, villas, townhouses, resort real estate, etc. had a significant drop.

This situation lasted until the end of 2022 due to suppressed challenges. Specifically, the State tightened credit policies to promote sustainable growth and intensified investigation of real estate enterprises. A series of top industry leaders imprisoned spread fears and caused delays in transactions and interruptions in ongoing projects. According to experts, these challenges were more impactful than the force majeure factor from the pandemic.

Despite bottlenecks happening in different segments, industrial real estate remained a highlight as occupancy rate of industrial parks surpassed 85%. Due to high demand from various sectors, the average occupancy rate of tier-1 markets in the North (including Hanoi, Hai Phong, Hai Duong, Hung Yen, Bac Ninh) was over 83.2%, as of Q4/2022. The industrial real estate in the South also recorded positive results with an average occupancy rate of 90% in Ho Chi Minh City, Dong Nai, Binh Duong, Long An.

The survey results of Vietnam Report showed that 28.6% of industrial real estate enterprises had their revenue and profit increased by more than 15% compared to 2021. This is a remarkable achievement of industrial real estate enterprises amidst the overall challenging market. As the market was fragmented by timing and by segmentation in 2022, there was also differentiation among the enterprises in the industry.

According to the General Statistics Office, the number of real estate businesses going out of business in 2022 was higher than during the COVID-19 outbreak with nearly 1,200 enterprises; while this number was 861 and 978 in 2021 and 2020 respectively. In the first quarter of 2023, 1,816 enterprises ceased business for a definite time and 341 enterprises dissolved.

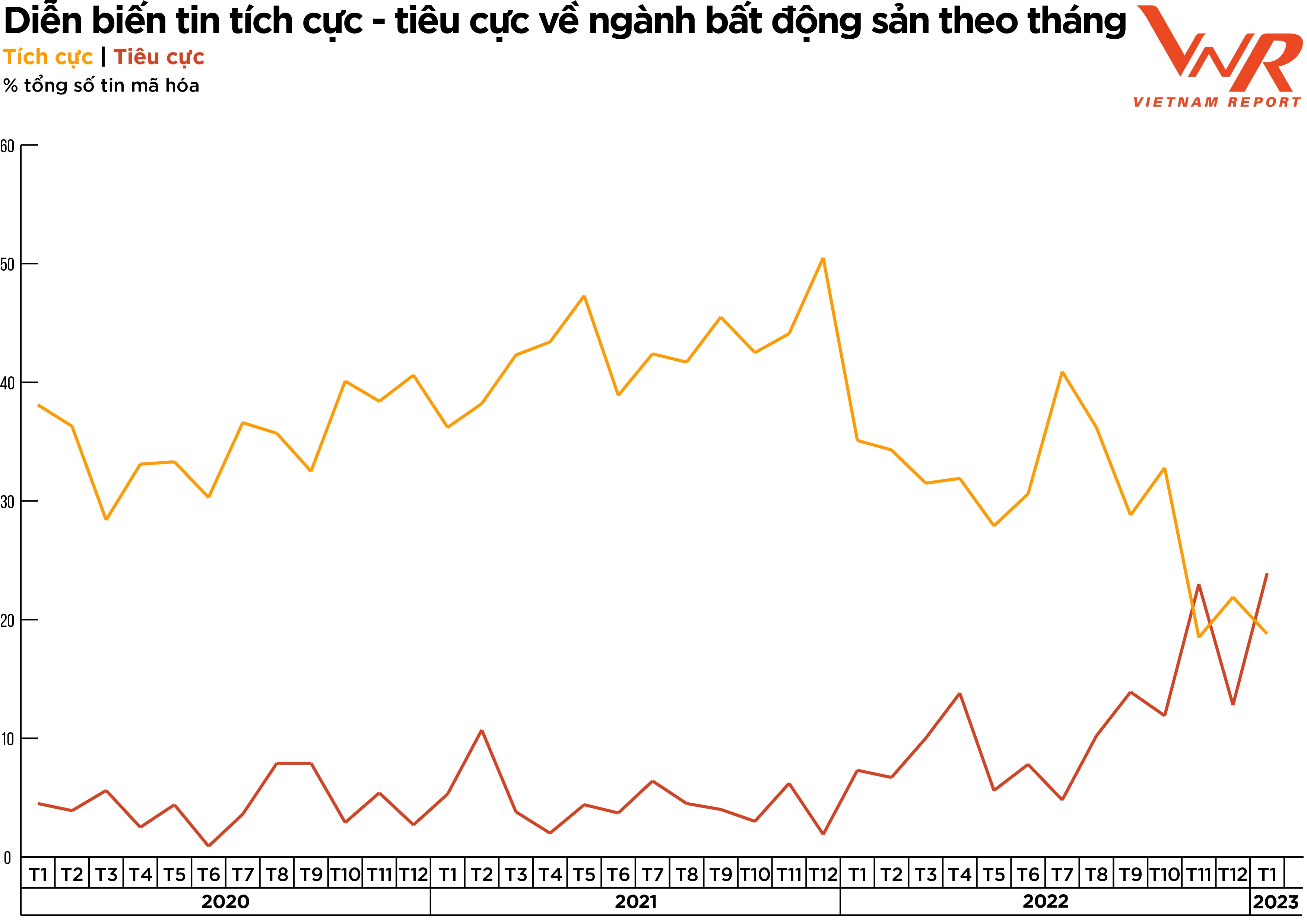

The realistic picture of the real estate industry over the past year was also documented in the media. The results of media analysis on influential channels show that negative news about the real estate industry in the last months of 2022 was the highest in the last 3 years. Negative information was only under control (less than 10%) until the end of July, and went above the roof in the following months due to unfavorable growth, a sharp increase in interest rates, difficulty in raising capital from bonds. Notably, there were times when negative news exceeded positive news (November 2022 and January 2023).

Figure 1: Positive and negative news about the real estate industry by month

Source: Media Coding data of real estate enterprises from 02/2020 to 01/2023, Vietnam Report.

In terms of quality of the information, an enterprise is "safe" if the difference between positive and negative information compared to the total amount of encrypted information is 10%, but the better is over 20%. According to research from February 2022 to January 2023, 57.7% of enterprises reached 10% and 42.3% reached 20%; while this figure was 73.8% and 65.4% a year ago, respectively. This means that the quality of information decreased accordingly with the business results.

Removing the bottleneck in cash flow to boost liquidity: The survival story of the real estate industry in 2023

A characteristic of the real estate business is an essential large amount of cash preserved in the medium and long term. Around the world, investment funds and the stock market are the main sources of capital for the real estate market. Meanwhile, in Vietnam, since regulations are not yet completed, enterprises in the industry are relying mainly on loans from banks and the individuals.

In the past 5 years, the sublimation of the stock market and the corporate bond market provided businesses with more resources to carry out investment projects. The recent stricter policies for project approval and the correction of the bond market by taking strong action against a number of organizations and individuals involved in the issuance of corporate bonds, despite being a necessary movement, has impacted the market and investors negatively.

In addition, fluctuations in the business environment and increasing inflation in the last 3 years has forced the central banks of many countries and Vietnam included, to tighten monetary policy (reducing money supply, increase interest rates) to control inflation and stabilize the socio-economic environment.

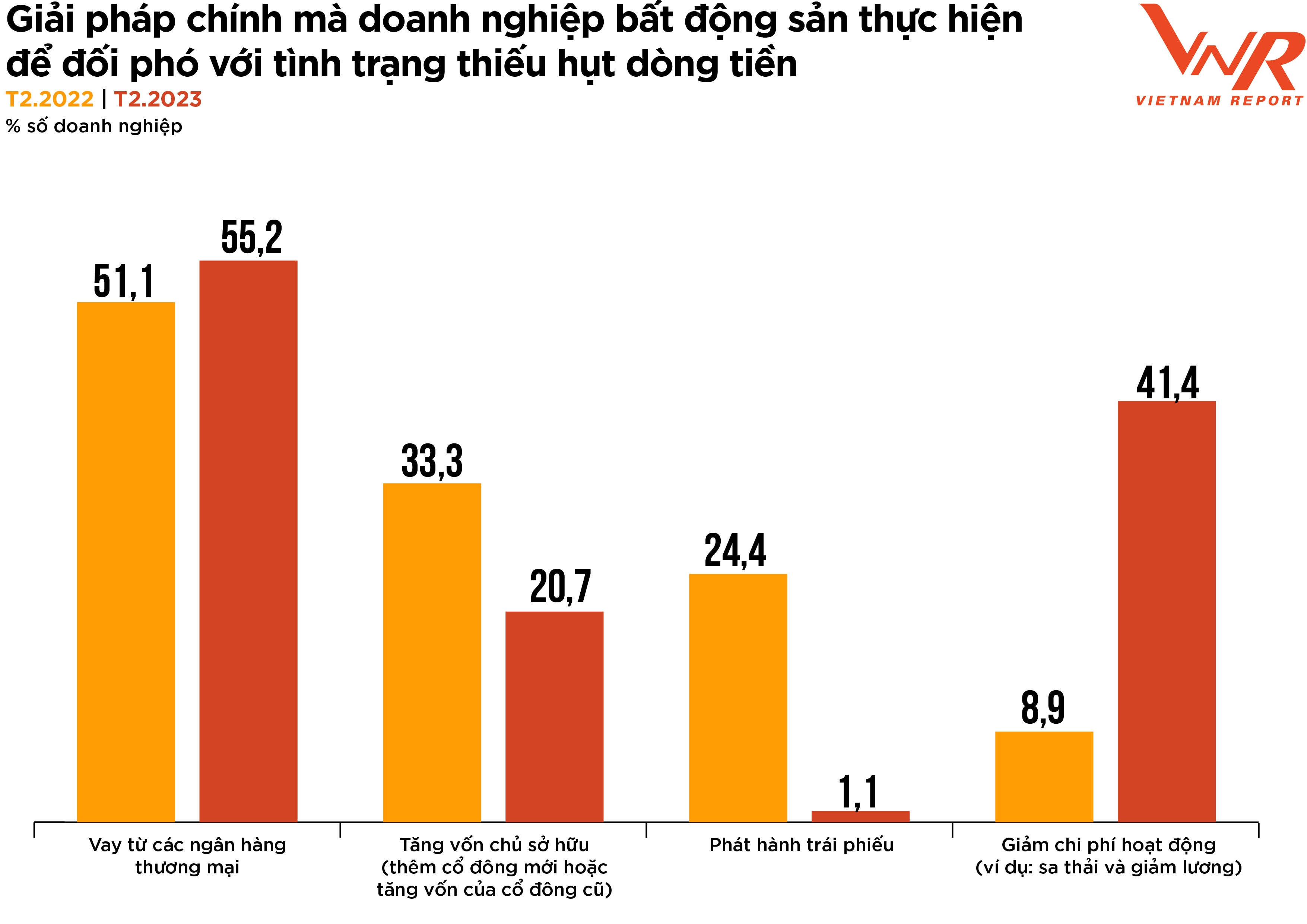

These factors damaged the financial capacity of enterprises and made it difficult for them to access investment from stocks, bonds, bank credit, and foreign loans. In response to the cash shortage, 55.2% of businesses surveyed by Vietnam Report chose to borrow from commercial banks, up 4.1% from the previous year, 41.4% would reduce expenses and cut costs. The proportion of enterprises that would issue bonds dropped sharply to 1.1% from 24.4%.

Figure 2: Main solutions businesses undertake to deal with cash shortage

Source: Survey of real estate businesses - Vietnam Report, February 2022 and February 2023

On the other hand, the Government has taken measures to remove difficulties for enterprises that do not have money to pay bond debt on time by issuing Decree 08/2023/ND-CP amending, supplementing and suspending the implementation of a Decree No.

There are a number of articles in the Decrees regulating the offering and trading of individual corporate bonds in the domestic market and the offering for sale of corporate bonds in the international market. Decree 08/2023, Decree 153/2020 and Decree 65/2022 are considered the Government's efforts to open up bond capital flows for the real estate market throughout the past period.

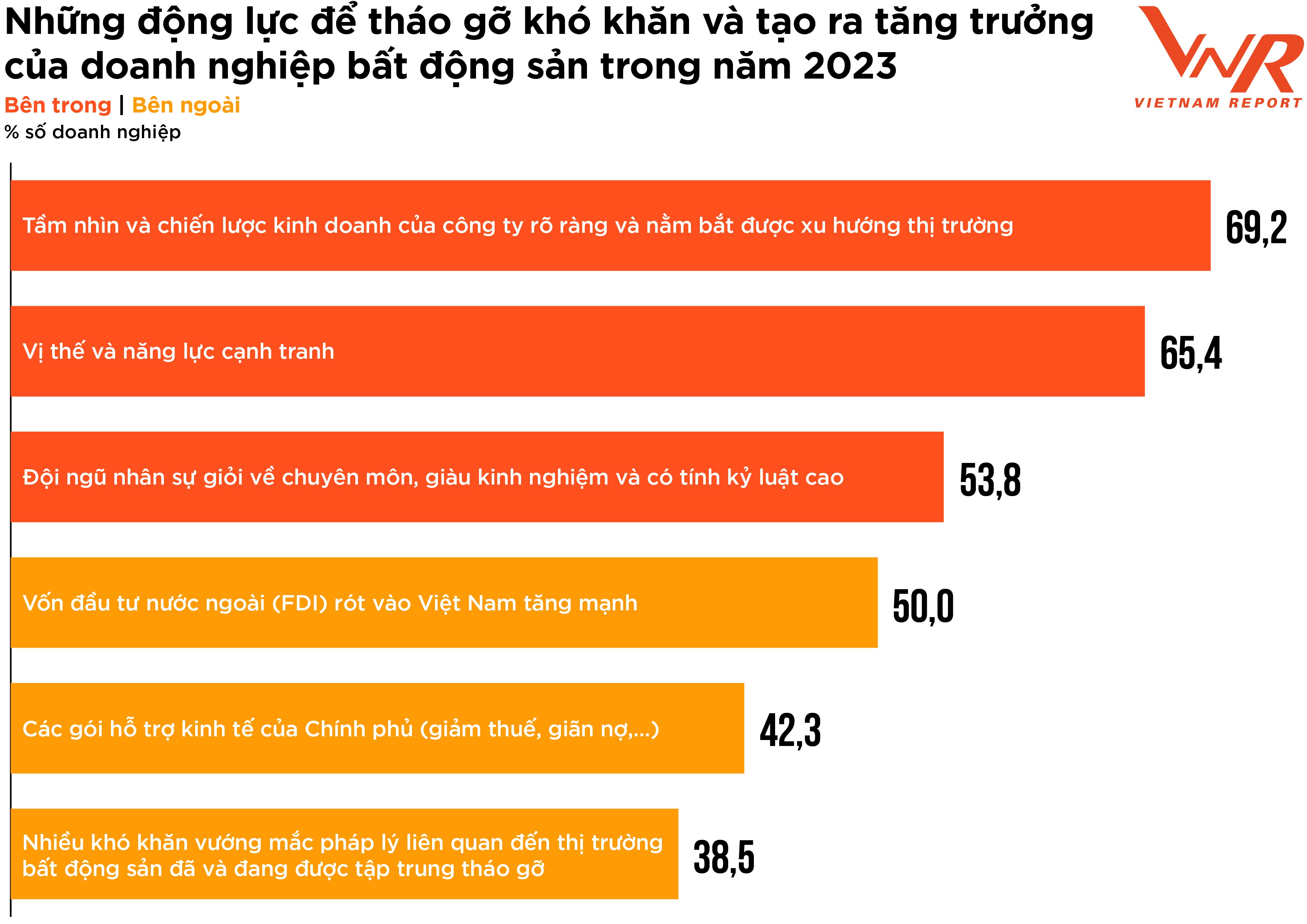

Besides the support from the Government, businesses in the industry are highly aware that they have to save themselves. The Vietnam Report published the top 6 driving forces for enterprises to overcome difficulties and grow, including: (1) Company vision, clear strategy and understanding of market trends; (2) Position and competitiveness; (3) A team of highly qualified, experienced and disciplined personnel; (4) Increasing of FDI into Vietnam; (5) Government's economic support packages (tax reduction, debt extension, etc.); (6) Many legal obstacles in the real estate market are being removed.

Figure 3: Driving forces for real estate businesses to overcome difficulties and grow in 2023

Source: Survey of real estate businesses - Vietnam Report, February 2023

Top 5 trends and prioritized strategies of real estate enterprises

While difficulties including limited capital, imbalance of supply and demand, overlapping legal issues, the impact of the economic recession remain in the market, the real estate industry in the coming time would not be positive. However, with the support of the Government and the capability of businesses, the real estate market is still capable of more positive changes.

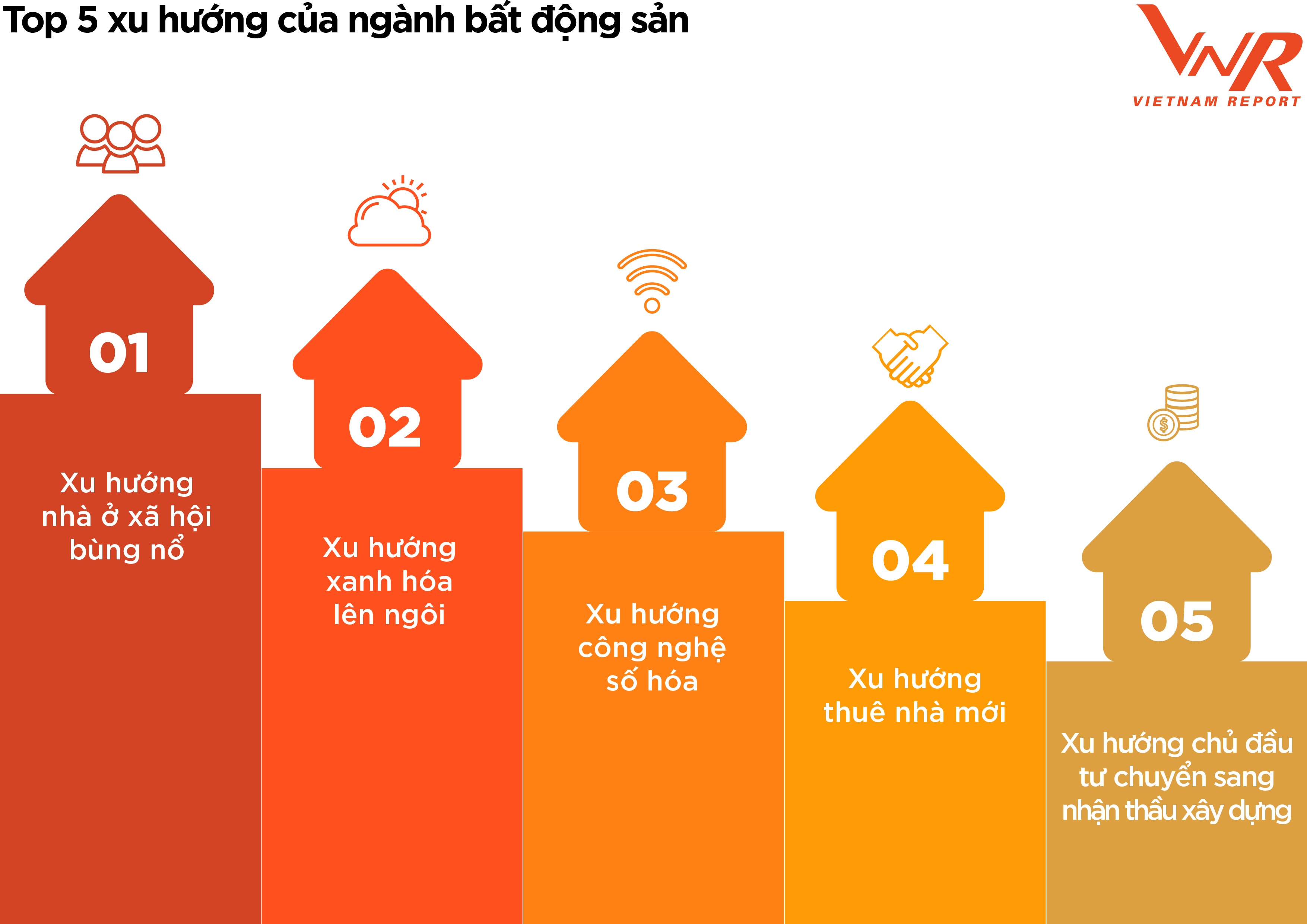

According to research by Vietnam Report, the social housing segment will be likely to explode following an increase in demand and the possibility that the proposal to “Build at least 1 million social houses for low-income workers in the period of 2021-2030" is approved. The increase of millions of social houses will bring balance to the current market which has a surplus in the high-end segment and a shortage in the lower segment".

Another rising trend, "green living", is also highly promoted as safety and health become top concerns. Additionally, digital transformation, renting new houses, investors switching to construction, are three prominent trends in the coming time.

Picture 4: Top 5 trends in the real estate industry

Source: Summary of interviews, surveys and media analysis of the real estate industry - Vietnam Report, February 2023

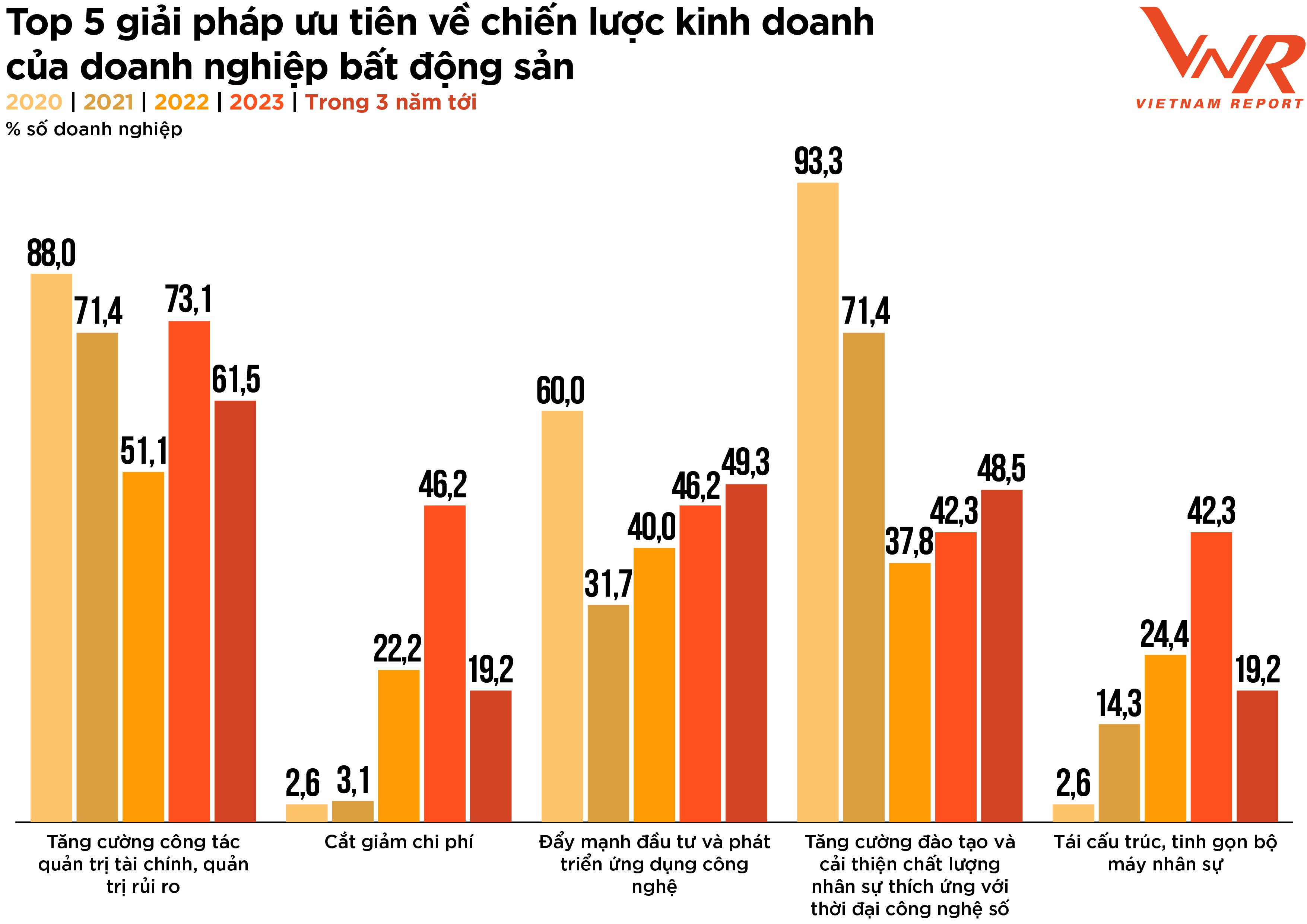

To overcome difficulties and welcome new opportunities, real estate businesses believe that it is necessary to prioritize 5 strategies: (1) Strengthen financial management, risk management; (2) Cut costs; (3) Promote investment and technology application; (4) Strengthen training and improve the quality of human resources to adapt to the digitalisation; (5) Restructure and streamline the organization.

Figure 5: Top 5 priority solutions for business strategy of real estate enterprises

Source: Real Estate Enterprise Survey - Vietnam Report, February 2020, February 2021, February 2022 and February 2023

In the current volatile global economy, 73.1% of enterprises prioritize strengthening financial management and risk management, aiming to improve operational efficiency, minimize the causes leading to the decrease in revenue and profit, and be proactive in response to unexpected situations.

The Cost cutting strategy has increased year by year but is expected to decrease in the next 3 years, as the market eventually recovers from the consequences of the prolonged COVID-19 pandemic. Businesses are gradually shifting direction, prioritizing digital transformation strategies, sustainable development strategies, etc. These current obstacles are both a test and an opportunity for businesses with stable financial and good resilience to become stronger.

These are businesses that actively and flexibly restructure, change capital structure, business strategies, approach new technology and market trends to create a breakthrough in the future, proving its reputation and position in the market, deserve to be awarded the leading enterprises in the real estate industry.

Source: Vietnamnet