Nam Long Investment Joint Stock Company (HOSE: NLG) estimated to achieve about 35% of the 2022 sales target after 5 months.

In the first 4 months of the year, NLG's sales almost reached VND 5,800 billion, majorly from Mizuki project (more than VND 1,700 billion), Flora Akari project (nearly VND 1,900 billion), Izumi City - Dong Nai project (more than VND 1,330 billion), Southgate and Nam Long Central Lake Can Tho (nearly 1,000 billion VND).

In May alone, NLG's sales reached VND 2,000 billion, mainly from the residences/villas of Waterpoint and The Mizuki. Thus, NLG sales in the first 5 months have accumulated at over VND 7,800 billion, fulfilling 35% of the 2022’s sales target.

In 2022, NLG targets sales revenue at VND 23,000 billion, 4 times higher than the revenue in 2021 of VND 5,927 billion.

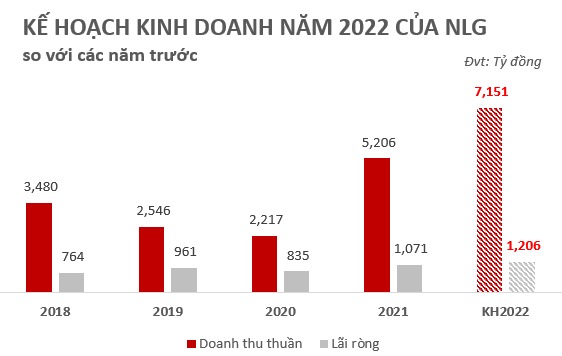

2022 is considered a big milestone for NLG as the company celebrates 30 years of development after many ups and downs of the real estate market. Celebrating the 30-year milestone, NLG sets a revenue target of VND 7,151 billion, up 37% and net profit of VND 1,206 billion, surpassing the trillion mark for the first time, up 13% compared to 2021.

Source: VietstockFinance

To accomplish the objectives, NLG will continue to launch a series of townships including Southgate (Waterpoint phase 1 - 165 ha), Mizuki (26 ha), Izumi City (170 ha), Akari , Nam Long - Can Tho (43 ha), Nam Long Dai Phuoc (45 ha), ... with a revenue target of USD 2 billion in the next 3 years.

Opening for sale Akari phase 2 in July, and will receive billions from IFC

According to Nam Long, in July 2022, 800 apartments of Akari phase 2 and 60 villas of Waterpoint will be on the market, with an estimated total value of about VND 3,700 billion.

In addition, it is worth mentioning that NLG has completed the required procedures to receive a disbursement of VND 1,000 billion from the International Finance Corporation (IFC).

Previously, IFC - a member of the World Bank, announced that it would buy VND 1,000 billion of bonds issued by Nam Long. The bond has a maximum term of 7 years, the collateral includes NLG's shares in Nam Long VCD and the joint venture company NNH Mizuki. The annual fixed interest rate is calculated by the total fixed base interest rate in VND plus the margin of 3.5%/year. The company pays bond interest every 6 months and the bond principal is divided equally into 3 payment periods every 3rd, 5th and 7th years.

Nam Long said it will use the proceeds from the bond issuance for Waterpoint phase 2 - an integrated township project in Long An province, including green public space, sports complex, schools, universities, healthcare center, as well as transportation infrastructure, retail and office buildings.

Nam Long’s Waterpoint project

“The investment from IFC will enhance our capability and help us provide more houses to middle-income residents in Vietnam. In addition, more than 5,000 apartments of Waterpoint phase 2, built according to IFC's EDGE standards (Excellence in Design for Greater Efficiencies) will help address the severe housing shortage in Vietnam in a sustainable way”, said Tran Xuan Ngoc, General Director of Nam Long.

Source: vietstock.vn